We can help you file your

Business Tax Returns

Let’s get down to business.

Your company’s success hinges on how well it manages its costs, streamlines operations, and, yes, how it files it’s returns.There are incredible variances between some firms’ bottom lines and others, simply from the way they process their books and prepare their returns. One cannot be done well without the other.

Getting your business returns completed, categorized, and processed each year is a different animal than personal tax prep, and is one our staff of tax attorneys and CPA’s are well armed to tackle. So whether you have a small consulting firm with modest income, or a large corporation with millions in annual revenue, our powerful business tax preparation, bookkeeping and planning can help manage a better bottom line.

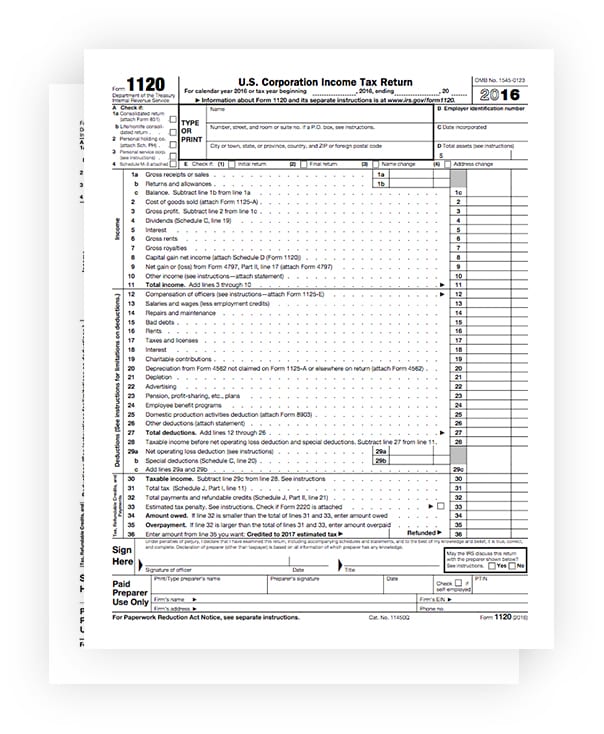

We’ve got you covered

Whether your business is a corporation, partnership, or LLC, we’ve got you covered with forms 1120, 1120S, and 1065.

Local & specialty taxes

We handle all local sales and specialty taxes on goods such as food and beverage sales, cigarettes, clothing, etc.

Payroll taxes

If you have employees, we properly report wages and handle the quarterly returns old and new, such as 940's and 941's, to keep you penalty free.

Don’t give the IRS

more money than you need to!

Running a successful business is hard enough, and most well oiled firms know that their approach to accounting must be rock solid to not only protect the company’s bottom line, but to keep it out of harms way. Many businesses can accumulate tax debt and face aggressive collection action at an alarming rate if their books are not complete, their payroll deposits not made on time, and their returns not accurately filed.

Our staff of bookkeepers, CPA’s and attorneys are well armed to keep your books up to date and perfectly balanced, make sure your payroll tax deposits are made on time to avoid penalties, and prepare your corporate returns year over year to keep you current and compliant.

We can maintain your returns

year over year

Getting your expenses itemized, your books in line, and your returns filed each and every year is a frustration many businesses delay until it’s too late. Procrastination is the number one culprit of most corporate tax debt, and meeting your IRS obligations on-time each quarter can help protect your firm against costly penalties and overpayment. Our team of tax preparers has spent years mastering the nuances of tax representation, and will bring your balance sheet up to par quickly. Once a simple on-boarding process is complete, we’re off to the races. Each year your books, deposits and returns will be on-time, error-free, and maximized for refunds.

Free eBook

Important IRS Deadlines

Besides April 15th, there are many other important IRS deadlines and dates that you need to know. Make sure and stay on top of all your personal and business filing dates and avoid needless penalties and interest with this valuable ebook.

Answers to questions

about business returns

-

Missed filing Payroll Taxes?

+We can go back and file any and all missing returns. We are compatable with Quickbooks, ADP, Paychex and many other payroll software systems.

-

Not sure how to file your business?

+We can create a comparison chart to ensure you file your business returns to put you in the best position possible, and our attorneys can help with any incorporation or entity management need.

-

Has your business taken a loss?

+We may be able to carry the losses back and reduce your debt on previous years.

-

Need more time?

+If you don’t have all of your records ready, and need more time to file, it’s ok. We file extensions too.