- browse by category

- Audit Assistance

- Business and Taxes

- Celebrities in Tax Debt

- Cryptocurrency Taxes

- Economic News

- Foreign Banking

- Innocent Spouse

- IRS Headlines

- IRS Wage Garnishment

- Marriage & Divorce

- Payroll Tax

- Retirement

- Revenue Officers

- State Tax Headlines

- Stop IRS Debt

- Success Stories

- Tax and Politics

- Tax Attorney

- Tax Codes

- Tax Debt Help

- Tax Evasion

- Tax Levy

- Tax Lien

- Tax Payment Plans

- Tax Return Filing

- Tax Tips

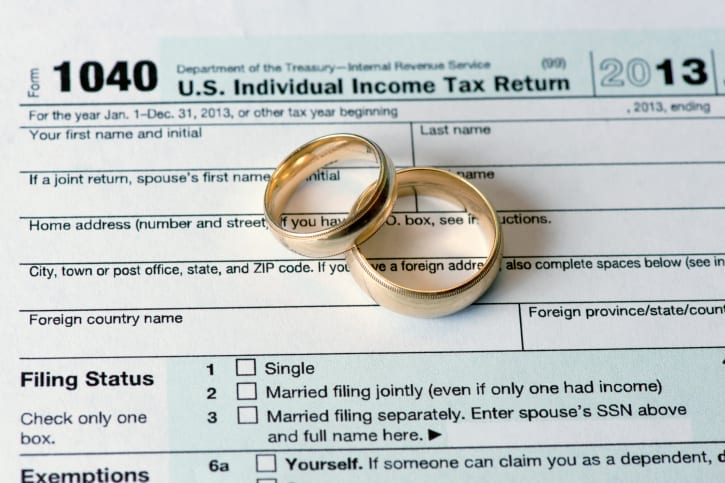

Marriage is an institution that goes back hundreds of years. And the idea of taxes is just as old. So we’re overdue in talking about marriage tax impacts.

People say “I Do” on one of the most important days of their lives: their wedding day. But it also ushers in a new way of approaching and paying taxes that lasts just as long as that sacred union of matrimony.

Aside from the moving in together, the name changes, and shared batches of laundry, marriage brings in a few changes to your financial situation you shouldn’t ignore.

Common Marriage Tax Impacts

Filing your taxes as Married Filing Jointly makes both spouses responsible for all the taxes due. That also includes interest and penalties on late returns. This filing status is generally advantageous if both spouses work with one earning a lot more. But if a divorce occurs, both spouses are still jointly and individually responsible for any back taxes due to the IRS that stem from a joint filing.

Should you try Married Filing Separately?

But there is another option: Married Filing Separately. But make sure to consult a tax professional to understand the ramifications. This status can be advantageous for a marriage that has a spouse facing sizable healthcare bills.

With two people married and making money, there’ll be more income to report to the taxman. This happens when a married couple’s income tax liability surpasses their tax liability as singles. So while you may wed your soul mate, you’re also wedding yourself with that additional tax burden known as the marriage penalty. But by consulting with a tax professional you may be able to reduce your tax burden as a married couple. That’s called the marriage subsidy.

The season your wedding takes place in may have an impact on the color scheme, but it matters to the tax man. As long as you tie the knot by December 31, you’ll be deemed as having been married that entire year. If you’re looking to avoid tax implications for as long as possible, getting married shortly after New Year’s Day might be the way to go.

Master the Marriage Tax Impacts

Your wedding date is the start of a new adventure, but it’s also a different way of dealing with the IRS. After you say “I Do” to your new husband or wife, make sure to meet with a tax professional so you can learn how to manage both of your finances simultaneously.

If you don’t, you may end up tying the knot with a bank levy or wage garnishment.

Leave Comments

Top Tax

secrets revealed

Sign up for our newsletter and be the first to find out when exciting IRS news happens. Yes, exciting. We're really into taxes.